Working with a Broker as a Freelancer: The Real Benefits

A broker offers benefits such as access to a network of clients, administrative support, and faster invoice payments.

You want to do great work, not drown in lead generation, contracts, and admin. Working via a broker (intermediary) can make freelance life smoother: more relevant opportunities, less paperwork, and stronger compliance with Dutch rules. This guide explains what a broker means for you, when it’s the right choice (vs. going direct), and how to get started.

What a broker is (and what it means for you)

A broker is an independent middle party between client and professional. In practice, that means a single, clear contract, standardised onboarding, timesheets and invoicing, and a point of contact who understands how large companies and the public sector buy external talent.

In short: you deliver your expertise; the broker handles contracts and admin, so you can start faster and stay focused.

What you gain as a freelancer

1) Access to more, and bigger, clients (including public sector)

Many attractive organisations (enterprises, municipalities, ministries) publish work through framework agreements, vendor portals, or the public-sector Dynamic Purchasing System (DAS). Brokers are often connected to these frameworks or help you respond to them. Result: you see opportunities you’d otherwise miss, and you work through a predictable process with clear deadlines.

What you’ll notice: more focused requests in your inbox, less guesswork, and better-fit assignments.

2) Less admin: one contract, one process

Instead of juggling different rules and portals for every customer, you get a single contract set and a standard flow.Good brokers are built for uniform contract management and tidy documentation. That reduces misunderstandings about end dates, extensions, and payment milestones.

- Onboarding

- Timesheet

- Unique invoice

- Payment

3) Payment & certainty (what to expect)

Brokers typically publish clear payment terms. Some also offer early-pay/factoring options or extras for independents such as insurance bundles or learning tools. You know what to expect, who to invoice, and when you’ll be paid—without chasing five people across departments.

Tip: before you accept, check who the legal counterparty is, the payment term, and whether early-pay or bundled services are available.

4) Compliance made easier (DBA, model agreements, WKA)

The Netherlands uses the DBA framework to prevent false self-employment. For each assignment, the working relationship is assessed; where appropriate, you’ll work under a model agreement. A good broker helps you get the statement of work and your documentation right, so you operate with confidence. They also understand chain liability (WKA) and arrange the right process for safe payments and records.

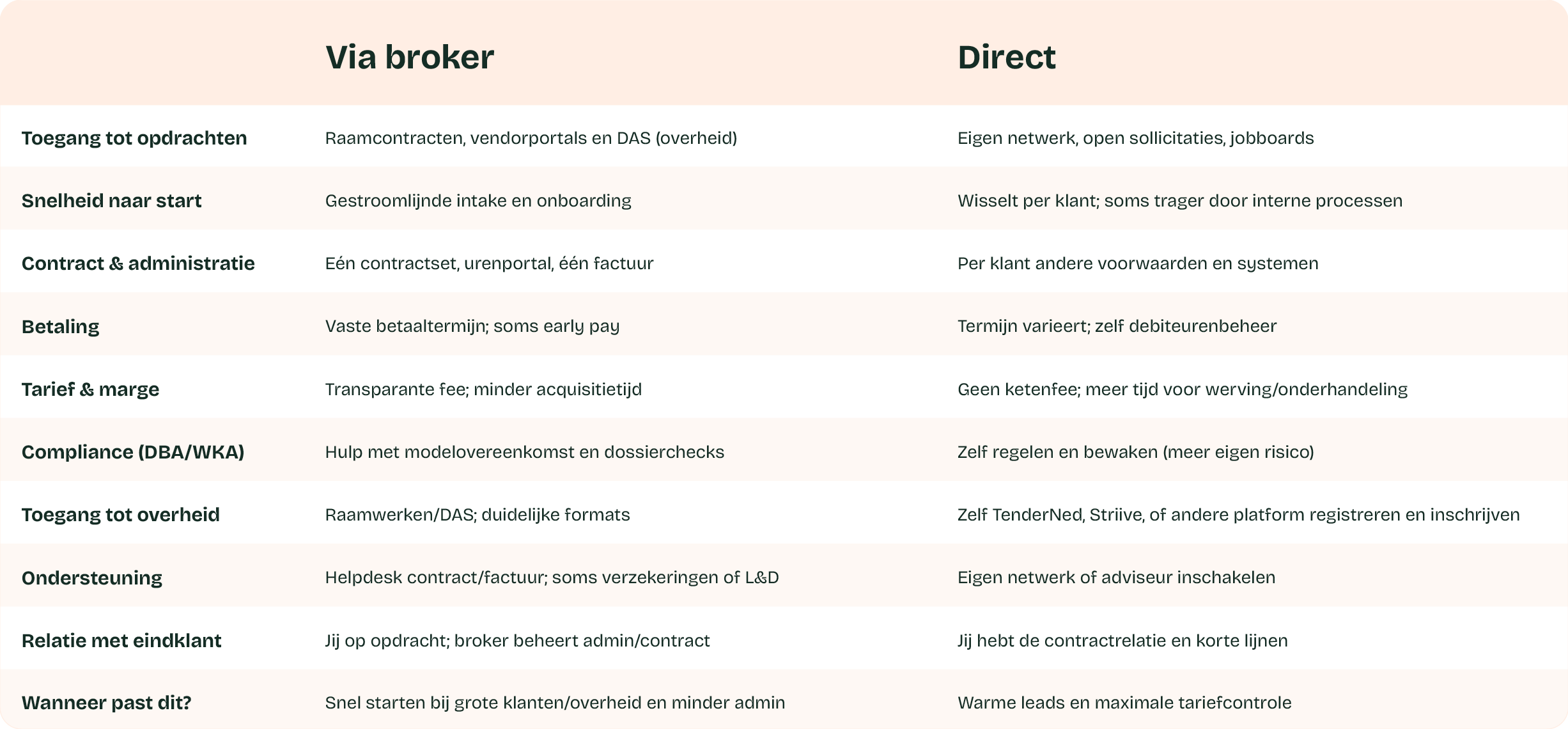

Broker vs. MSP vs. direct: how to choose

- Via a broker → Best when you want quick starts, less admin, and access to large clients/public sector (often behind frameworks or vendor portals).

- Via a MSP → Similar day-to-day for you, but the MSP manages the client’s entire contingent workforce program (strategy + tooling). You’ll still benefit from structured intake, processes, and predictable payment.

- Direct with the client → Best when you already have a warm intro, want to set your own terms, or you’re working with smaller clients without portals.

Step-by-step: getting started via a broker

- Register & complete your profile. List skills, certifications, sector experience, availability, and regions. Use common job titles clients actually search for.

- Verification. Expect ID and Chamber of Commerce checks; in some sectors, a VOG (certificate of conduct) or diploma proof may be required.

- Match & intake. The broker reflects the client’s requirements and helps you tailor your proposal. Keep two templates ready (commercial vs. public sector).

- Contract & onboarding. Sign digitally and get set up for tools/timesheets, security rules, and reporting.

- Timesheets, invoice & payment. Submit hours and invoice according to the format; you’re paid on the agreed term (sometimes with early-pay available).

30-minute action checklist (do this today)

- Update your LinkedIn headline with a clear title + 2–3 specialties.

- Prepare two short case snapshots (situation → approach → result) as a one-pager or deck.

- Register with 2–3 brokers that specialise in your niche/region.

- Turn on alerts for relevant vendor portals/DAS categories and terms you care about.

- Confirm payment terms and counterparty before you start.

- Store DBA documentation (statement of work, model agreement, key emails) in one place.

Common mistakes (and fast fixes)

- Chasing only the highest rate > Fix: include payment certainty, time-to-start, and admin load in your decision. Net value beats headline rate..

- Messy or incomplete documentation > Fix: submit evidence on time (CoC extract, ID, possibly VOG/certificates). Use the right model agreement and formats.

- Wrong category on a portal/DAS > Fix: map your skills to the right segment; ask the broker to review titles/keywords before you apply.

- Skipping the quality check on the intermediary > Fix: verify credentials, ask fellow freelancers for references, and read the payment clause carefully.

Get moving with Striive

With Striive, you get smarter matching and clear processes for contracting and payment. You keep control over your craft and your choices—while we reduce the admin and help you find work with clients (including public sector) that fit you.

Stap-voor-stap: zo start je via een broker

- Inschrijven & profiel vullen. Maak je skills, certificaten, sectorervaring en beschikbaarheid compleet.

- Verificaties. Reken op ID-check, KvK, soms VOG of diploma’s (afhankelijk van sector/opdracht).

- Match & intake. De broker spiegelt eisen uit de aanvraag en helpt je voorstel scherp te maken.

- Contract & onboarding. Je tekent (vaak digitaal) en krijgt uitleg over urenregistratie, tools en security-regels.

- Uren, factuur & betaling. Registreer uren, dien factuur in volgens het format; je wordt betaald volgens afgesproken termijnen (soms met early-pay optie).

Checklist: vandaag geregeld

- Werk je LinkedIn-headline en profiel bij met de meest gevraagde NL-zoekwoorden.

- Verzamel 2 korte cases (situatie → aanpak → resultaat) als pdf of deck.

- Schrijf je in bij 2–3 brokers die in jouw niche en regio actief zijn.

- Zet alerts aan op inhuurmarktplaatsen/DAS-categorieën die bij je passen.

- Check betalingsvoorwaarden en contractpartij vóór je start.

- Bewaar DBA-documentatie (opdrachtomschrijving, modelovereenkomst/afspraken) centraal.

Veelgemaakte fouten (en snelle fixes)

- Alleen op tarief sturen > Fix: kijk ook naar doorlooptijd, betalingszekerheid, scope en DBA-borging; soms levert dat netto meer rust en rendement op.

- Onvolledig dossier > Fix: lever tijdig bewijs (KvK, ID, evt. VOG/certificaten) en gebruik het juiste model/format.

- Verkeerde categorie op DAS/marktplaats > Fix: meld je aan in juiste segmenten en lees eisen/knock-outs; vraag de broker om hulp bij match en formulering.

- Geen kwaliteitscheck op intermediair > Fix: check het BOVIB-keurmerk en referenties van de partij waarmee je in zee gaat.

Aan de slag met Striive

Via Striive matchen we opdrachtgevers en professionals slim aan elkaar. Jij krijgt toegang tot passende kansen (ook in gereguleerde sectoren), duidelijke processen voor contract & betaling en een toegankelijke aanpak in gewoon Nederlands. Zo houd jij focus op je vak, terwijl wij de rompslomp lichter maken.