Female independent professionals are earning more than men for the first time. What does this mean for the labor market?

Female independent professionals are earning more than men for the first time. What does this mean for the labor market?

In the latest Talent Monitor by Intelligence Group and HeadFirst Group, we see a development that until recently seemed almost unimaginable: for the first time, female independent professionals earn more per hour on average than their male counterparts.

This turning point is not only historic; it also says a great deal about how the labor market is shifting and which dynamics will shape the years ahead.

A catch-up process that has been underway for years

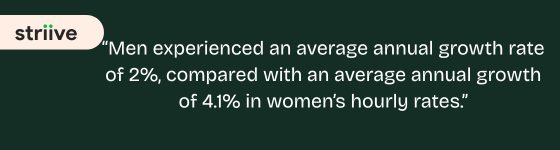

Although the traditional pay gap remained visible among self-employed professionals for many years, female freelancers have made a clear catch-up over the past decade. According to the report, women’s average hourly rates have been rising faster than those of men for more than ten years now.

In 2024, the tipping point was reached: the average hourly rate of female self-employed professionals is now higher than that of men.

How did this shift come about?

The report identifies several factors that help explain this development:

1. A changing composition of the self-employed workforce

More women are choosing self-employment, particularly in higher-priced roles: specialist, senior, and often scarce profiles.

This results in relatively strong representation at the top end of the market.

2. Men are more often active in broader segments

The male self-employed population is larger and more diverse. It includes a relatively high number of professionals operating in middle- and lower-rate segments, which pulls down the average.

3. Sector differences play a major role

Sectors in which men are overrepresented—such as ICT—are experiencing slight downward pressure on rates.

By contrast, sectors with a high concentration of women—such as healthcare and certain forms of specialized professional services—are showing continued growth.

4. Greater transparency and attention to equal pay

The rise of the platform economy, online marketplaces, and increased rate transparency has made differences that could only be explained by gender more visible—and therefore more likely to be corrected.

The report concludes that the so-called “unexplained pay gaps” have largely disappeared.

Why this tipping point matters

This development goes beyond a simple comparison between men and women. The underlying trends reveal broader shifts in the labor market:

1. Seniority and specialization are becoming decisive

Where formal education level once largely determined rates, direct deployability, expertise, and market scarcity now carry significantly more weight.

2. Gender is becoming less of a determining factor in pricing

This points to a more professional and transparent freelance market, where market value is less influenced by demographic characteristics.

3. Organizations need to reassess their assumptions

Many HR and procurement departments still operate on traditional assumptions: higher education equals higher rates, men are on average more expensive.

The data shows the opposite. This calls for updated policies, more robust rate analyses, and sharper hiring strategies.

Will the gap widen?

Most likely, yes. Researchers expect women’s lead to continue growing in the coming years—not because men are becoming less valuable, but because the market itself is structurally changing:

-

More women entering niche roles

-

Rising rates in healthcare and specialized professional services

-

Continued pressure on ICT and generic profiles

-

Increasing rate transparency

If these trends persist, the current gap will naturally continue to widen.

What does this mean for independent professionals and suppliers?

For independent professionals, this development underscores that expertise, seniority, and specialization carry more weight than gender. Those who position themselves clearly within a niche or scarce profile see this reflected in their market value. Traditional assumptions about rate differences are fading, giving way to a more data-driven assessment of value.

For suppliers, this means that rate guidance and matching need to become sharper and more objective. No longer based on demographic characteristics, but on scarcity, skills, and up-to-date market data. Suppliers that base their rate estimates on facts rather than assumptions will remain relevant in a rapidly changing market.

Conclusion

The fact that female self-employed professionals now earn more on average than men is not a coincidence, but the result of structural changes in the labor market.

This trend highlights the growing importance of seniority, specialization, sector dynamics, and the way rates evolve in an increasingly transparent market.

Curious to explore all the trends of 2025 and the outlook for 2026? Download the full report here (In Dutch).

Grijp je volgende kans!